时间:2024-02-10|浏览:269

用戶喜愛的交易所

已有账号登陆后会弹出下载

Supply impact: It is expected that the issuance of Bitcoin will be halved around April 2024. Although miners' income will face challenges in the short term, basic on-chain activities and positive changes in market structure mean that this halving is essentially different from the past.

Miner strategy: Faced with reduced block reward income and high production costs, miners are raising funds by issuing stocks/bonds and selling reserves to relieve short-term financial pressure.

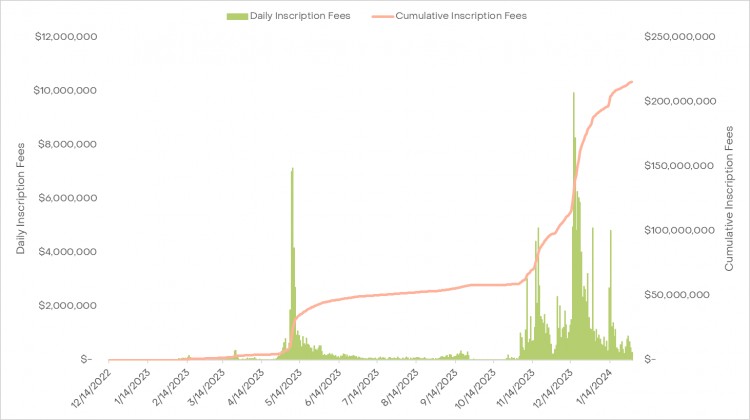

The continued growth of on-chain activities: The introduction of ordinal inscription brings new vitality to on-chain activities. As of February 2024, more than 59 million NFT-type collectibles have been engraved on the chain, creating more than $200 million in transaction fees for miners. This trend is expected to continue, fueled by renewed developer interest and continued innovation on the Bitcoin blockchain.

Impact of Bitcoin ETFs on the market: Continued adoption of Bitcoin ETFs may significantly absorb selling pressure, potentially reshaping the market structure of Bitcoin and providing new, stable sources of demand for prices, which is beneficial to prices. of.

As we approach the 2024 halving event, Bitcoin isn’t just surviving, it’s evolving. With the historic approval of a U.S. spot Bitcoin ETF and changes in market liquidity, the structure of the Bitcoin market is changing. In this article, we’ll take a deep dive into the halving – what it is, why it matters, and its historical impact on Bitcoin’s performance. Next, we’ll look at Bitcoin’s current situation and why it looks so different than it did a year ago.

What is halving?

New Bitcoins are generated through a process of "mining" in which computers solve complex computational problems to win block rewards of new Bitcoins. Bitcoin's issuance is limited by design—approximately every four years, mining rewards are halved, thus cutting the issuance of new coins in half.

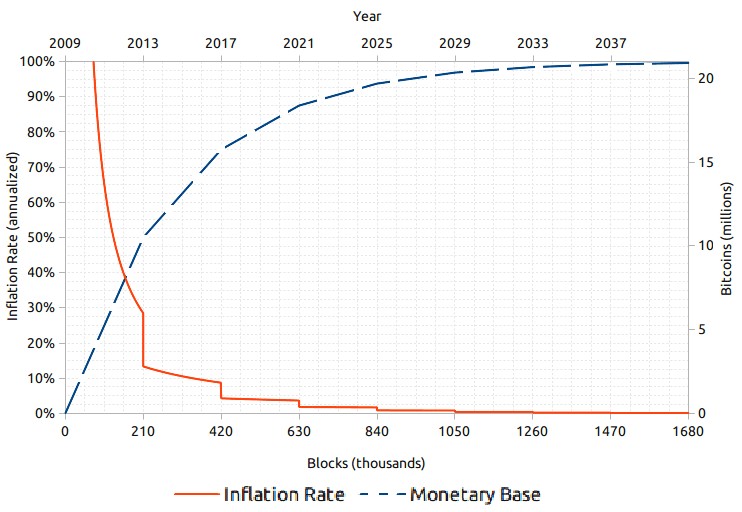

Chart 1: Bitcoin’s supply schedule

This deflationary property is one of the main attractions for Bitcoin holders. Unlike fiat currencies, whose supply is determined by central banks, or precious metals whose supply is affected by natural forces, Bitcoin's issuance rate and total supply are dictated by its underlying protocol from the start. The combination of a fixed total supply and a tapering inflation rate not only creates scarcity but also has deflationary properties built into Bitcoin.

In addition to the obvious supply implications, the significant excitement and anticipation surrounding Bitcoin’s halving also stems from its historical correlation with Bitcoin price increases:

Chart 2: Bitcoin price trending higher after halving

However, it is important to understand that a rise in Bitcoin price after the halving is not inevitable. Given the highly anticipated nature of these events, if the price increase is known, rational investors may buy in early, causing the price to increase before the halving occurs. This raises questions about analytical frameworks such as inventory flow models. While the model creates a visually appealing chart by correlating scarcity with price increases, it ignores that this scarcity is not only predictable but also widely known. Looking at other cryptocurrencies with similar halving mechanisms, such as Litecoin, does not consistently see post-halving price appreciation, suggesting that while scarcity sometimes affects price, there are other factors at play.

Rather than saying that post-halving price increases are entirely caused by the halving itself, it is better to say that these periods coincide with the occurrence of major macroeconomic events. For example, the 2012 European debt crisis highlighted Bitcoin’s potential as an alternative store of value amid economic turmoil, prompting its price to rise from $12 to $1,100 in November 2013. Likewise, the initial coin offering (ICO) boom of 2016 – which attracted more than $5.6 billion into altcoins – also indirectly drove the price of Bitcoin from $650 to $20k in December 2017. Most notably, expansionary fiscal stimulus during the COVID-19 pandemic in 2020 fueled inflation concerns, potentially prompting investors to view Bitcoin as a hedge, causing its price to rise from $8,600 in 2021 $68k in November. These periods of macroeconomic uncertainty, and efforts to find alternative investment options, appear to coincide with periods of increased interest in Bitcoin, coinciding with the halving event. This pattern suggests that while halvings help reinforce Bitcoin’s scarcity narrative, the broader economic context, and its impact on investor behavior, also plays a crucial role in Bitcoin’s price.

While the future macroeconomic environment remains uncertain (despite our own opinions), the impact of the halving on Bitcoin’s supply structure is certain. Let's explore this further.

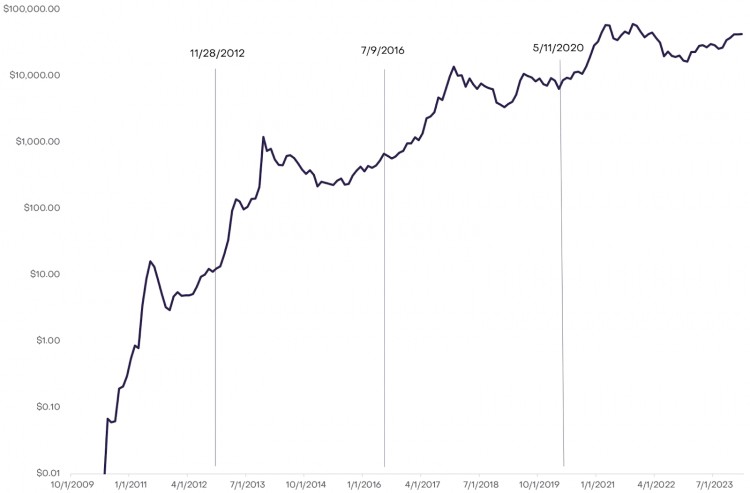

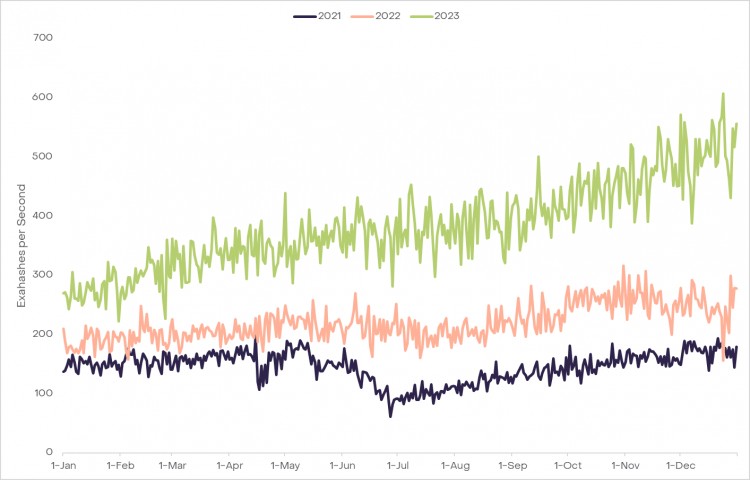

Challenges faced by miners

The halving is a challenge for Bitcoin miners. As Bitcoin issuance decreases from 6.25 BTC per block to 3.125 BTC, the revenue miners receive from block rewards is effectively halved. At the same time, costs are rising. Hash rate—that is, the total computing power used to mine and process transactions on the Bitcoin network—serves as a proxy for mining difficulty and is a key factor in calculating miner fees. In 2023, the seven-day average hash rate surged from 255 exahashes per second (EH/s) to 516 EH/s – a 102% increase that significantly exceeded 2022’s 41% increase. The surge is driven in part by a rise in Bitcoin prices in 2023 and as a result of businesses purchasing more efficient mining equipment in response to positive market conditions, highlighting the growing challenges faced by miners. The double whammy of falling revenue and rising costs may leave many miners feeling stressed in the short term.

Chart 3: Computing power hits record high in 2023

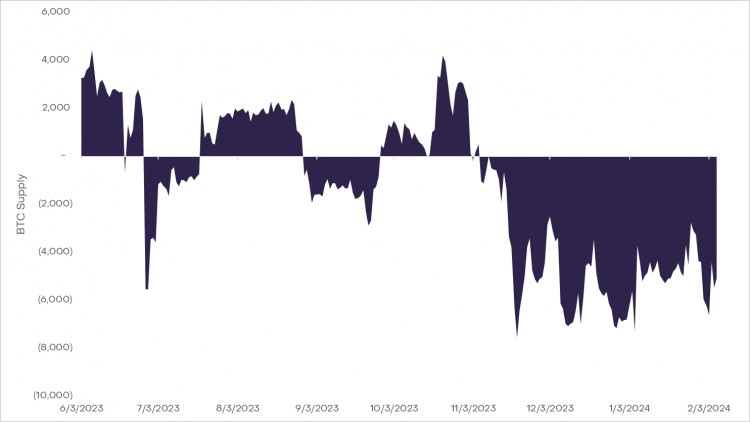

While the outlook may seem worrying, there are signs that miners are already beginning to prepare for the financial consequences of the halving. In Q4 2023, it became apparent that miners were selling their Bitcoin holdings on-chain, presumably as a way to build liquidity before block rewards were reduced. Additionally, notable fundraising efforts like Core Scientific’s $55 million equity offering, Stronghold’s $15 million equity raise, and Marathon Digital’s ambitious $750 million hybrid equity raise underscore the industry’s aggressive approach to bolstering reserves manner. Collectively, these measures suggest that Bitcoin miners are on track to cope with the coming challenges, at least in the short term. Even if some miners exit the market entirely as a result, the corresponding drop in hash rate may lead to an adjustment in mining difficulty, which may lower the per-coin cost for remaining miners and maintain the stability of the network.

Chart 4: Changes in miners’ net positions

Despite the challenges posed by decreasing block rewards, the growing role of ordinal inscription and Layer 2 projects in the Bitcoin ecosystem has recently provided miners with a glimmer of hope, possibly through increased transaction volume and network transaction fees. Provide some kind of relief.

ordinal inscription

As we discussed previously, ordinal inscriptions ("ordinals") represent an innovation within the Bitcoin ecosystem. From simple images to customized “BRC-20” tokens, digital collectibles can be uniquely “imprinted” on a specific Satoshi (the smallest unit of Bitcoin, each Bitcoin is subdivided into 100 million Satoshis). This new dimension of Bitcoin’s utility has fueled significant growth: to date, more than 59 million assets have been imprinted, generating over $200 million in transaction fees for miners.

Chart 5: Daily and Cumulative Registration Fees (USD)

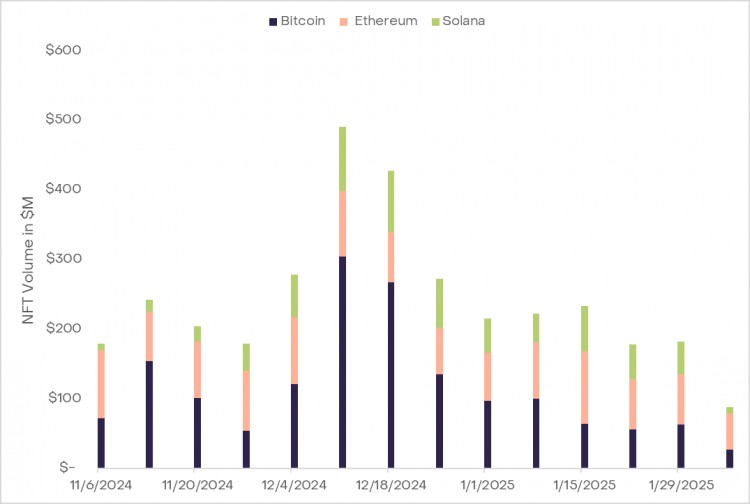

This surge in network fees, with transaction fees on the Bitcoin network surpassing the Ethereum network for the first time on November 20, 2023, marked a significant change. Since the advent of ordinal numbers, there have been multiple times where miners received more than 20% of transaction fees from imprinting fees. Even compared to the total NFT volume on other chains, Bitcoin became the dominant NFT transaction volume in November and December 2023, a development that few expected in late 2022.

Chart 6: NFT transaction volume by chain

The success of ordinal numbers also brings its own challenges to the Bitcoin network. As block rewards decrease over time, how to incentivize miners to continue protecting the network becomes a more pressing issue. With ordinal transaction fees already accounting for approximately 20% of miners’ total revenue, this emerg