时间:2024-03-21|浏览:236

用戶喜愛的交易所

已有账号登陆后会弹出下载

According to the latest data, U.S. Bitcoin spot exchange-traded funds (ETFs) surpassed the significant milestone of $150 billion in cumulative trading volume on March 19.

The development is particularly noteworthy given the spot ETF’s relatively short time on the market after receiving approval from the U.S. Securities and Exchange Commission (SEC) less than three months ago.

However, despite this milestone success, the market is not without its challenges. While Bitcoin prices fell significantly yesterday, record net outflows from Bitcoin spot ETFs were also observed.

Record trading volumes and market dynamics

The U.S. spot BTC ETF’s cumulative trading volume exceeds $150 billion, reflecting the market’s strong interest and participation in cryptocurrencies. It’s worth noting that a large portion of this trading volume was recorded in a relatively short period of time, with an increase of $50 billion since March 8 alone.

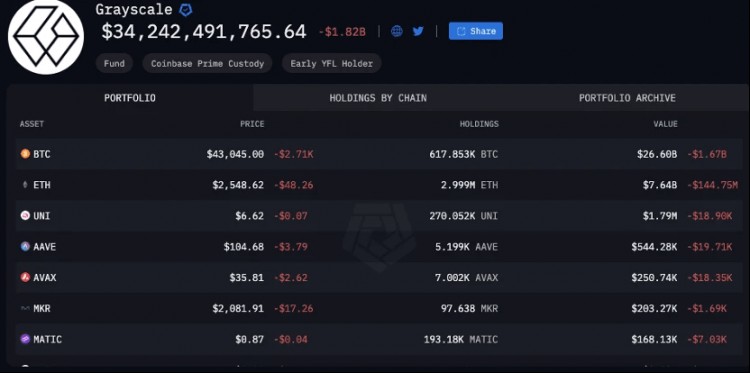

Additionally, trading volume reached $5.6 billion yesterday alone, led by BlackRock’s IBIT, Grayscale’s GBTC, and Fidelity’s FBTC, highlighting investors’ active participation in these financial products.

However, this enthusiasm was tempered by a major shift in the market, with Grayscale’s GBTC experiencing a market share “squeeze” amid daily outflows.

On the contrary, BlackRock's IBIT became the main beneficiary, with its market share increasing significantly from 22.1% at the beginning of its establishment to 45.2%.

Bitcoin Spot ETFs’ Record Outflows and Vulnerability

U.S. spot Bitcoin ETFs saw net outflows of $326.2 million, more than double the record of $158.4 million set earlier this year, underscoring the inherent volatility of the cryptocurrency market.

This outflow has been particularly evident in Grayscale's GBTC, with the fund experiencing significant redemptions, a sign of investor caution amid market volatility.

Amid this development, Peter Schiff criticized spot Bitcoin ETFs, highlighting a major flaw: their liquidity is limited by U.S. market hours.

Schiff emphasized that this restriction means that if a market downturn occurs outside of these hours, investors cannot sell their holdings until U.S. markets resume trading, leaving them with a "helpless" response to overnight market moves. #比特币现货ETF #交易量