时间:2024-03-09|浏览:205

用戶喜愛的交易所

已有账号登陆后会弹出下载

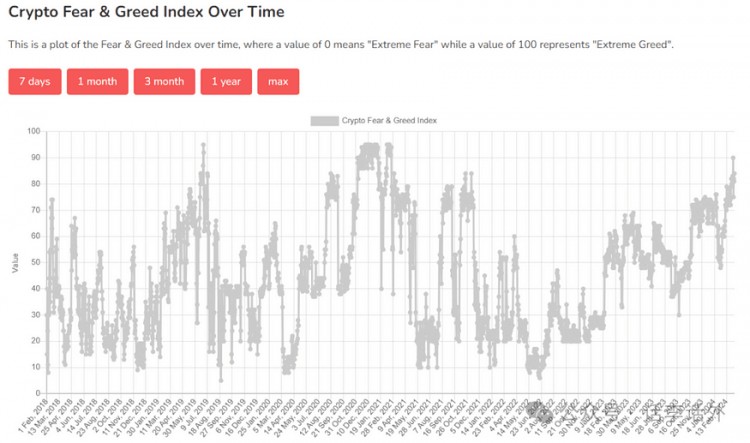

The market sentiment has continued to rise recently, and many people have started to get excited. Those who have chips in their hands seem to be running out of money. Now many people have left messages asking me: Should I sell the pie first at the current position and wait for it later? Buy again after a pullback.

No matter who asks me, I still say the same thing many times: If you urgently need to cash out, then you can consider selling part of the pie now, but don’t sell out. If you don't have such an urgent need, then continue to hold it and don't move it. The big bull hasn't come yet, so don't get involved now!

In addition, don't always think about doing "sell high and buy low". This operation is actually not as easy as you think. Hold on, hold on, don't be thrown off before the big bull comes. As for whether you should use your existing big pie to exchange for the copycat, and then wait for the copycat to make more money, then exchange it back to the big pie (coin-based). I don’t make specific suggestions on this. It depends on your personal risk preference. . Anyway, I won't change it. I suffered too many losses in this area before, and it still leaves a bit of a psychological shadow. Now my personal risk preference is relatively low.

When it comes to making money, we also mentioned in the previous article that more than 90% of people in the encryption market lose money. In fact, I have said this more conservatively. I originally wanted to write that 99% of people lose money. It lost money, but even though it was written in a more conservative way, it was still labeled by a certain platform as "the title may be exaggerated or inconsistent with the content" haha.

There do seem to be a lot of opportunities in this field, and most people come in because they hear or see some stories about getting rich in this field. But as I mentioned above, only 1% of traders in this market are actually profitable, and the remaining 99% may end up losing money. Don't ask why this is the case. If you must ask, I can only tell you two words: human nature. Moreover, I don’t want to argue with some people about the right or wrong of this issue. Of course you can think this statement is wrong, but I still hope that you are one of the 1%.

As far as the encryption field is concerned, in fact, some new concepts or stories will appear in every cycle, and projects under many concepts also provide huge trading (speculation) opportunities, and there is even a lack of thousands or even tens of thousands of times. story. But please note that the word I use here is story. To put it bluntly, 99% of people cannot be the protagonists of the story. At most, they are only participants or bearers of the story.

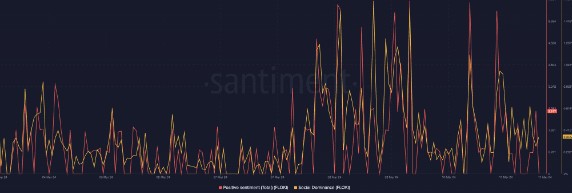

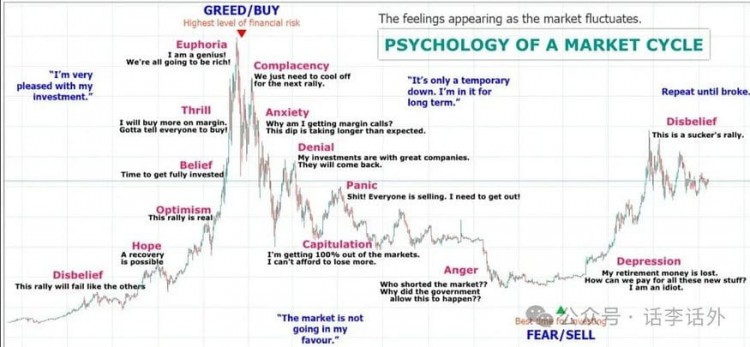

Let’s look at a classic old picture next, which can help us understand the market rules within a cycle very intuitively. This is also a process of change in human nature (as shown in the picture below):

When it comes to investing specifically, many newcomers are brainless when it comes to gambling, or follow others to buy (for example, they just buy what others say without doing basic research. In fact, this is also a sign of brainlessness) . The old leeks are relatively rational. They will conduct their own research, but most of the research is based on speculation or prediction based on historical data. This is fine for some old projects, but for new projects, because of the new The historical chart data of the project is limited, there are very few (or even no) various types of data that can be studied, and there are also very few support/resistance levels on the K-line. You can’t even see (can’t search) much information about the project. Information and evaluation of reference value.

However, as we mentioned above, in a new cycle, new concepts (new projects) often perform better than old projects. Most of those stories that are hundreds, thousands, or even ten thousand times are new projects. Creative. So, if you want to be in the 1%, investing in new concepts (or new narratives) may increase the odds of that success.

So, how do you become one of the 1%? Or what do you need to do if you want to be one of the 1%?

This is actually a very complex issue, and from a certain perspective, it seems that hundreds of past articles by Hua Li Hua Wai can be said to have revolved around this theme. And the discussion on this issue seems to be endless, because so far, there is almost no general "cheats" that can directly make a person become the 1% in a short time.

Of course, in order to avoid cute little ones getting into trouble, I would like to add one more point. What I am talking about here is ordinary people. As for the 1% chance based on those indescribable backgrounds, it is definitely not suitable for most ordinary people. Not everyone A third brother from the bottom can become the richest man in a certain state.

In Hua Li Huawai's article on new project operation methodology a few days ago (March 5), he sorted out three minimalist ideas (primary ideas) for trading new projects. So today, we will continue to follow this idea and try to give you some extensions (advanced ideas). Next, we will mainly discuss the use of Fibonacci indicators.

1. About Fibonacci indicator (Fibonacci)

The Fibonacci indicator is one of the most popular indicators in financial markets and is used by many traders to look for potential retracement levels in trending markets to determine possible support and resistance levels for prices. In the Fibonacci sequence, each number is equal to the sum of the previous two numbers. The sequence starts from 0 and 1, followed by 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233 and so on.

What’s interesting about this sequence is that when you divide the previous number in the sequence by its next number you always get the same ratio of 0.618. This ratio is also known as the golden ratio. Traders use these ratios in trading. Possible retracements in price can be found and possible areas of support and resistance can be found.

Applied to specific trading, the most popular Fibonacci retracement levels are 23.6%, 38.2%, 61.8%, and 78.6%. Of course, here we are only briefly explaining its basic concepts. For more in-depth usage strategies of Fibonacci, interested friends can search on Google by themselves.

2. Look for new projects (tokens) with strong startup power

The so-called strong startup power mainly refers to new projects that have good price performance after being launched. After understanding the Fibonacci indicator, we can then use this indicator to find opportunities in new projects (new tokens) with strong startup power.

We can draw Fibonacci charts through tools like Tradingview. Here is a simple drawing demonstration using TIA as an example. As shown below.

From the picture above, we can clearly find that the price of TIA has now backtested to 0.236, and has also experienced a period of consolidation in this range. If you are optimistic about the future development of this new project, then every backtest When it reaches the key position, it is the time for you to buy and build a position.

So in theory, if you pay more attention to new projects and have projects that you are more optimistic about, then after the new currency is listed, you can buy some according to the opportunity every time it passes the Fibonacci retracement level. But if you are using this indicator for short-term trading, the risk of using it in this case will be relatively high. You may need to pay attention to several points at the same time: first, try to buy above the consolidation; second, try to avoid Buy on the initial breakout (which requires some consolidation time).

3. Look for new projects (tokens) that started weak but rebounded strongly

There is another situation. Sometimes you may also find this phenomenon. For example, the new coins that have just been launched seem to have little strength (some even perform very weakly). It feels as if the market makers have not woken up yet, and The leeks are not very communicative either. The more a new coin performs like this, the less likely other investors will pay attention to and trade it, unless they are those die-hard fans who were already very optimistic about the long-term development of the project before its tokens were launched.

But you may also find a phenomenon at the same time. Once the market makers "wake up" and the leeks also "wake up", then the new currency will quickly start to take off, and many people will start to pat their thighs and Go for the highs.